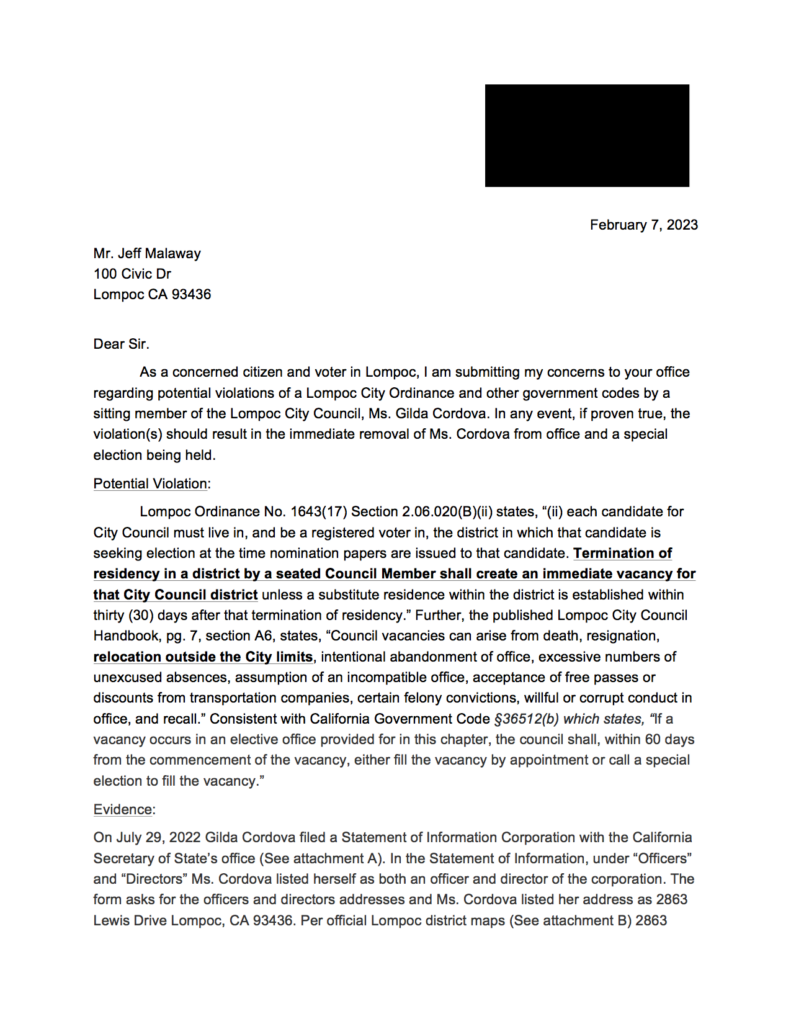

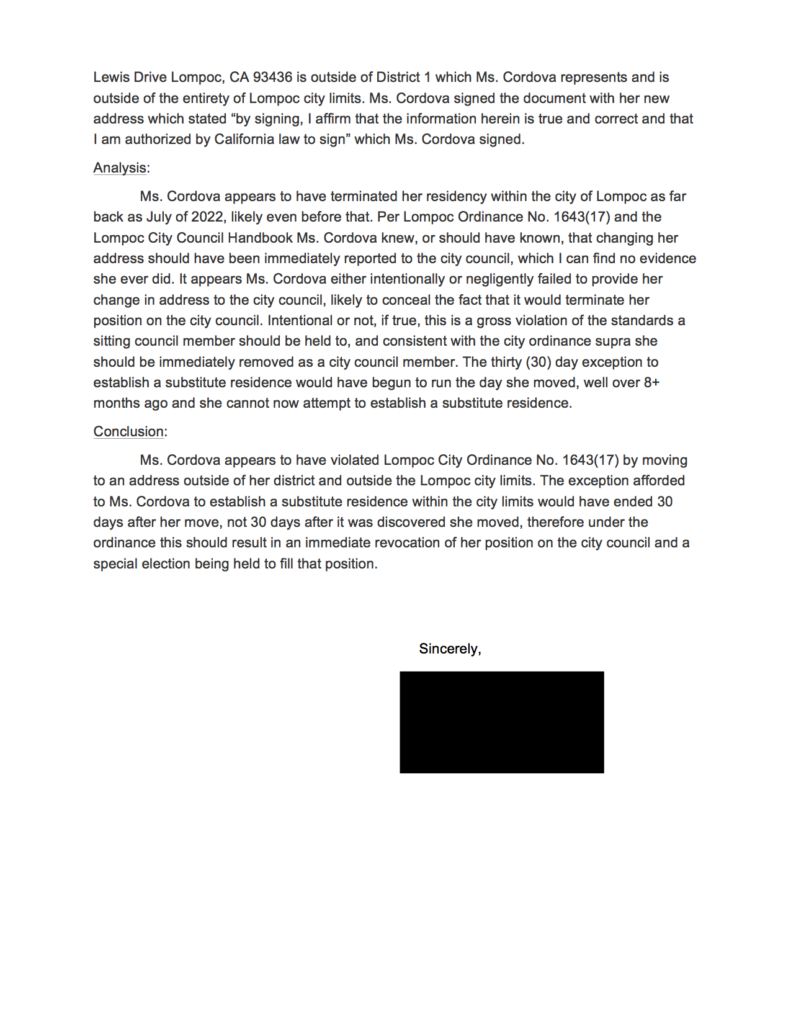

In a recently obtained document, a local Lompoc Resident has submitted a legal complaint against City Council Member Gilda Cordova.

The complaint reads that the City Council member, does not reside in her elected District, and according to the rules, cannot officially serve on the city council.

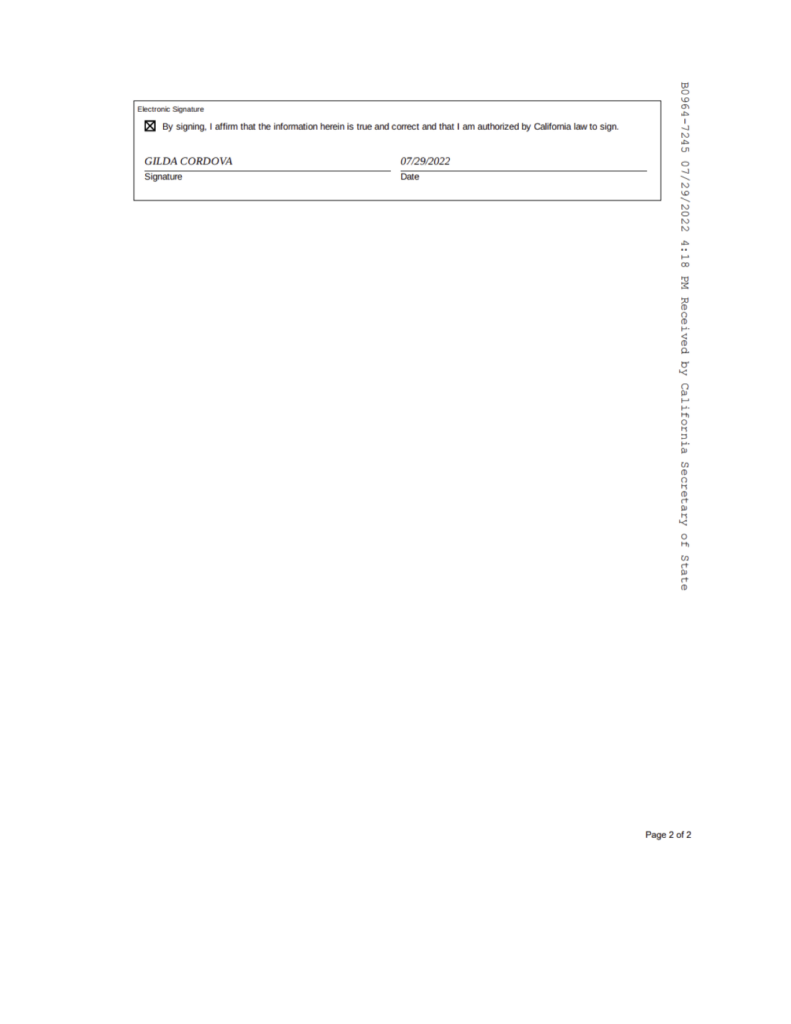

During the interview, it was additionally added that when the initial complaint was filed, there was only evidence of listing the address, out of the district, as a primary residence on a Statement of Information corporate filing update. However, in recent investigations, they also uncovered that tax filings show the City Council member also received home-owner tax breaks, as part of the residence being ‘the primary residence of domicile’.

In county tax filings additional documents were also able to obtain and verify information that showed the house was sold at far below market value when suspiciously the price dropped from $900,000 down to $645,000 at the peak of the housing market. Documents also showed the seller of the house was the current employer of City Council Member Gilda Cordova, and board members of ExploreLompoc, VisitLompoc Inc.

The implications of this are that City Council Member Gilda Cordova may be using her position as President of ExploreLompoc & a City Council member to gain secret contracts & favors from staff, city lawyers, and employers, along with organizations that have contracts with the city of Lompoc. It was noted that many people inside city hall are aware of this. The implications range from Banking fraud to Tax Evasion, and possibly ethical breaches that could legally have ramifications for ExploreLompoc funds & contracts.

The official documents that were obtained from a local citizen’s group that submitted to the Lompoc City Lawyer, the Notice of Domicile outside the District.

Update Since Complaint being Filed:

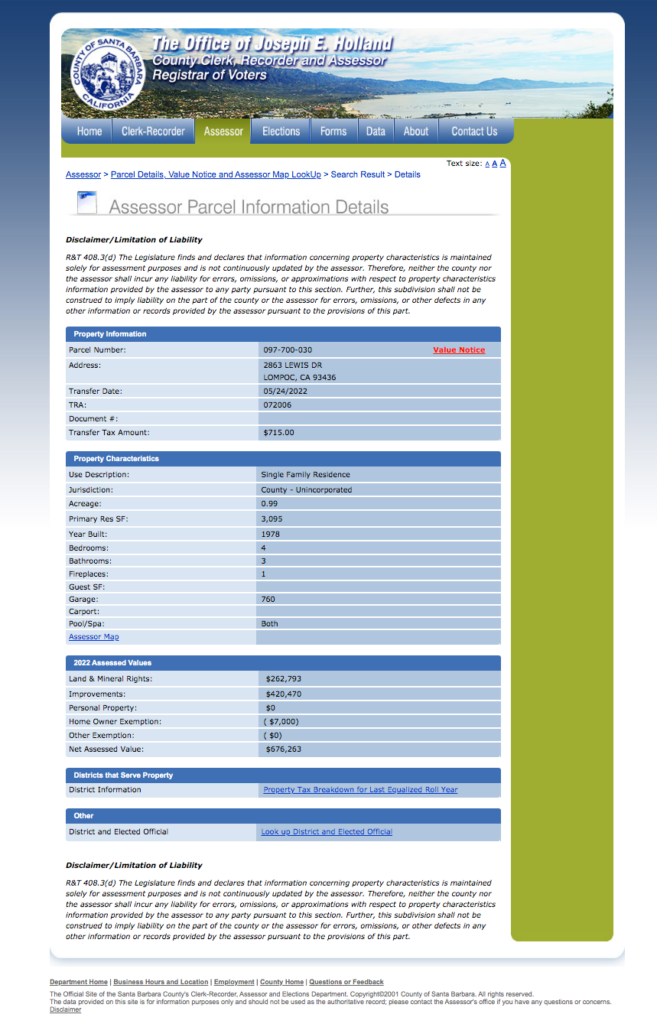

If you own a home and occupy it as your principal place of residence on January 1, you may apply for an exemption of $7,000 from your assessed value. Below we can see the residence was listed as a primary residence by receiving the tax break.

So the implication here is that either the City Council Member is residing out of District, or potentially breaking tax laws.

County Assessor Parcel Information